Youth Trends That Brands Need To Know in 2025

Published: July, 2025

Are you ready for today’s youth market? In 2025, 15–30-year-olds move carefully and expect more, whether they spend, post, or choose brands. Youth Pulse Wave 4 (April 2025) reveals exactly how their confidence, habits, values, and digital lives are shifting.

This blog delivers fresh data, category-specific insights, and a human-toned analysis that reflect what’s changing—and what your brand must do to keep up.

The Big Shift: Financial Confidence & Cautious Spending

38% of youth expect their financial situation to improve in the next 6 months (up from 34% in Wave 3).

15% expect their finances to worsen.

35% say they expect to increase their spending, while only 19% expect to decrease it.

Nearly a quarter of all youth leisure spending goes to virtual products (24%), up 1 percentage point from last wave.

Country differences: Italy showed the biggest jump in spending optimism, while France and the UK saw small declines.

Youth spending in 2025: What it means for brands?

Young people are tightening their wallets, skipping “nice-to-have” buys, and being choosy—with price, necessity, and proof of value now essential for every purchase.

Where Youth Spend Their Time: Social Media Tops Everything

You don’t need TV to launch a youth trend in 2025. Social media is king—by far.

Fast facts:

96% use social media monthly

On average, 2.4 hours/day are spent on social platforms

Platform preferences

YouTube (76%)

Instagram (74%)

TikTok (73%)

Female preferences:

TikTok: 74%

Pinterest: 59%

BeReal: 36%

Average TikTok time: 2.86 hours/day

Male preferences:

Discord: 44%

Twitch: 33%

Reddit: 35%

Average TikTok time: 2.39 hours/day

Are youth “too online”?

53% of young people admit they spend “too much time” online.

41% already set time limits or take “digital detox” breaks.

Why should brands care?

The digital feed is where youth discover, research, and judge brands. If you aren’t on social, you’re invisible.

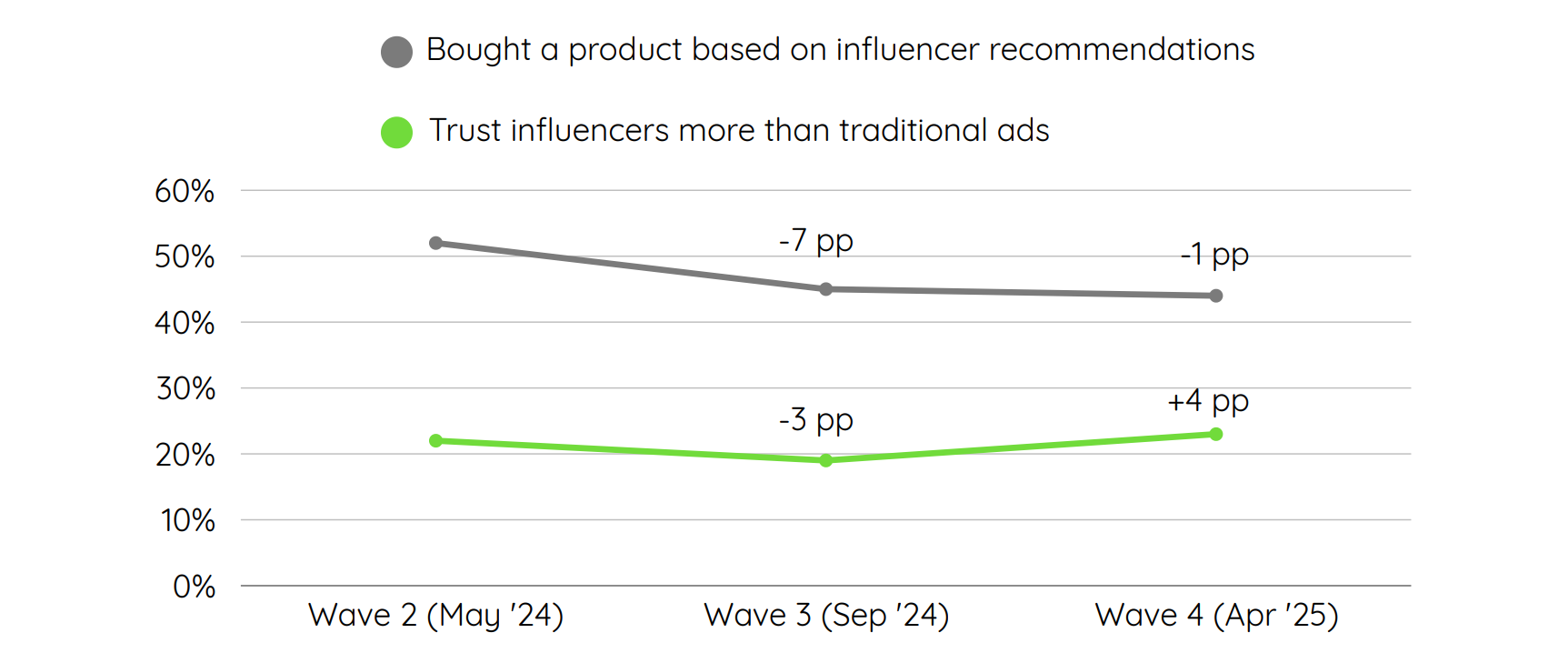

Influencers: Still Relevant, Now Under the Microscope

Are influencers still driving sales? Yes—but only for those who win real trust.

44% of youth bought a product because of an influencer recommendation (down from 45% last year).

Only 29% buy instantly; most double-check with friends or research.

What matters now?

Creators who reply, host Q&As, and share “real life” details get more loyalty.

Follower count is less important; transparency and interaction are everything.

Almost 70% say friends or group chats influence them after seeing a creator’s post.

Youth demand #ad disclosures, honest reviews, and relatable stories, not just celebrity slogans.

Attitudes & Values: Sustainability, AI, and Boycotts

Sustainability is now non-negotiable:

71% say eco-friendliness drives purchases

77% bought second-hand or upcycled items in the past 6 months

35% say sustainability means “recycling or reselling items they no longer use.”

What Counts: Recycling, minimal packaging, local production, and circular practices.

AI is a tool, not a compass:

68% use AI-powered tools (for school, entertainment, or creativity).

Just 15% trust AI with important decisions (career, health).

Top AI worries: job automation (27%), misinformation (27%), loss of human connection (25%).

Boycotts & political views shape buys:

23% say politics affect their buying decisions

15% people said the current political climate significantly influences their decision to purchase products manufactured in the US.

Loyalty is rising toward local and European brands

Deep Dives: 2025’s Key Categories With Real Data

Food: Health, Affordability, Localism

48% of those not vegetarian/vegan eat plant-based at least once/week.

Top trends: Zero-waste cooking, vegan indulgent treats, global street desserts

Non-Alcoholic Drinks: Function and Clean Labels

44% cite sugar as their top concern; mood & brain-boosting drinks and “natural” are rising fast.

40% want beverages with added vitamins; plant-based milks (oat, almond, soy) are now the norm.

Bubbly, sugar-free flavored waters are replacing soda.

Alcohol: Less Is the New Cool

52% of youth consume alcohol; 48% of females, 56% of males.

32% prefer alcohol-free at social events.

Trends: Pre-mixed cocktails, innovative fruit wines, and coffee-based drinks.

Fashion: Second-Hand, Unique, Eco Counts

77% of youth buy second-hand fashion (up from 63% in Wave 3).

Top motivations: Cost savings (56%), unique finds (36%), sustainability (33%).

Big themes: Upcycled pieces, gender-fluid fashion, Y2K revival, and minimalist basics.

Personal Care & Beauty: Clean, Included, Minimal

18% are ‘highly invested’ in personal care.

52% discover new products on social media—beating stores or friends.

Minimalist “skinimalism”, blue light protection, upcycled beauty products, and gender-neutral options are top trends.

Mental Health & Digital Wellbeing: Healthy Boundaries Matter

35% say social media takes up 'too much time'; another 42% try but keep the balance.

76% have tried limiting their online time with app limits, detoxes, or replacing scrolling with hobbies.

Brands that support positive habits and respect digital boundaries gain loyalty.

Recap Table: Our Core Findings For You

| Theme | Insight |

|---|---|

| Social Media Usage |

• 2.4 hrs/day • 81% youth use social media • YouTube, Instagram, TikTok dominate |

| Influencer Trust Rates |

• 23% trust influencers more than ads • 41% bought via influencer recommendation |

| Consumer Confidence |

• 25% positive • 65% expect to spend less |

| Sustainability Values |

• 71% buy eco • 54% bought second-hand/upcycled this year |

| AI Trust |

• 68% use AI • Only 15% trust AI for big life decisions |

| Boycott / American Products |

• 23% influenced by politics • 16% actively avoid US goods |

| Fashion |

• 77% buy second-hand • 46% buy for cost • Upcycling, Y2K fashion rise |

| Personal Care |

• Minimalist, eco packaging • 52% discovered via social media |

| Digital Wellbeing |

• 53% say they’re “too online” • 76% limit screen time |

Takeaways: What Should Brands Do in 2025?

Lead with proof: Don’t just say you care—show it with data, receipts, and transparency.

Be social-smart: Meet youth where they are, with native, interactive content.

Prioritize purpose: Purpose-driven brands that take real action build trust.

Stay local: Youth increasingly value regional identity and European roots.

Support balance: Help youth manage digital overload instead of feeding it.

Conclusion: The 2025 Youth Market Isn’t Just Changing—It’s Leading

Europe’s young consumers are intentional, information-hungry, and skeptical of empty trends or promises. They ask “why” before every purchase, prize honesty and peer input, and expect brands and influencers to act with purpose and proof.

If you want to win youth loyalty this year, you need to meet them:

Where they are. On their terms. With their values.

Source: All figures and insights are taken from the Opeepl Youth Pulse Wave 4 report (April 2025).

Discover more about youth trends among 15-30 y.o in our latest Youth Pulse Report

Final Thought: Influence Is About Resonance, Not Reach

Here’s the bottom line:

Young people aren’t just following influencers. They’re co-creating their digital experiences with them.

They want:

Real stories

Honest reviews

Shared values

And creators who act more like friends than walking billboards

So, whether you’re a brand, a researcher, or a marketer trying to reach this generation, here’s the key: stop trying to go viral.

Start to connect. Because influence today isn’t about being loud. It’s about being real, relevant, and worth listening to.

Discover more trends among 15-30 y.o. in Youth Pulse Report

Opeepl Youth Pulse is a bi-annual study that keeps pulse on the latest developments in the youth market. Discover key youth trends in consumer confidence, media habits, attitudes, values, and five major categories: Food, Beverages, Alcohol, Fashion, and Personal Care.